Category Analysis: Energy Drinks

The energy drink market is undergoing a remarkable switch towards health-conscious products, packed with functional ingredients such as vitamins, electrolytes and natural extracts that support well-being offered in sustainable and eco-friendly packaging. Demands for low-sugar, zero sugar and attention to the types of sugar substitutes are top of mind for consumers who want it all: refreshing flavors, something they can easily carry to school, work or the gym, electrolyte replacement, and if sweeteners are present, they must be natural and not sabotage a workout.

Much like the consumers who guzzle these beverages, energy drinks aren’t slowing down. The market is growing, driven by a 20 percent increase in portable formats to fit into consumers’ on the go lifestyles, a 15 percent rise in sales within gyms and fitness centers to quench thirst and replace electrolytes during and post workout, a 30 percent surge in new flavor and formulation launches attracting diverse consumer preferences and a 22 percent year-over-year growth among youths who are enticed by the promise of increased energy, according to media reports.

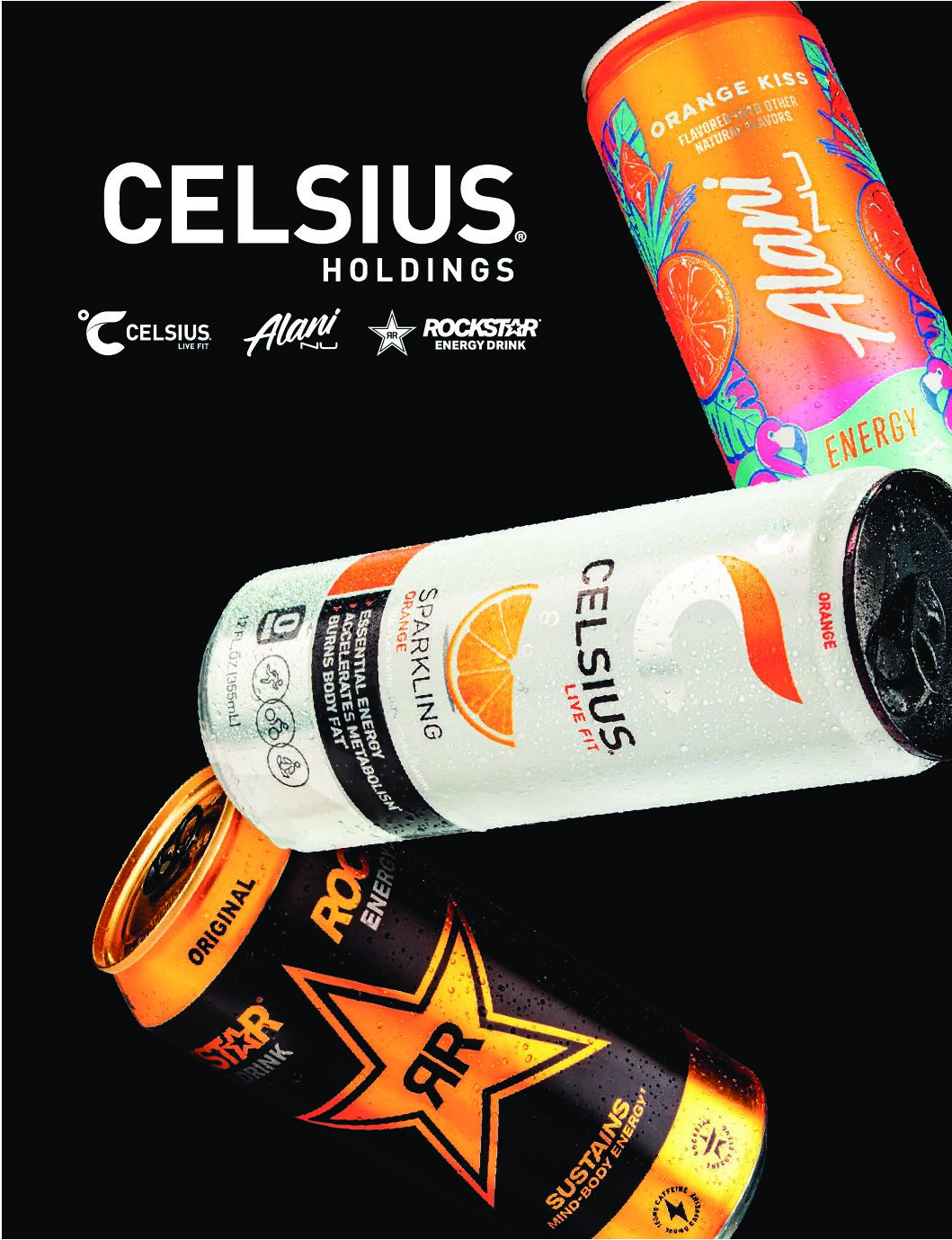

“2025 has been a transformative year for Celsius, marked by rapid expansion and growth within the energy drink category,” said Tyler Bohannon, EVP—North American Sales. “The acquisition of Alani Nu earlier this year added a second billion-dollar brand to our portfolio, adding a brand with triple-digit growth to our portfolio and strengthening our position with Gen Z and Millennial female consumers. Together, Celsius and Alani Nu have gained meaningful share, with the two brands now accounting for more than 18 percent of the US ready-to-drink energy category and excelling in MULO as two of the leading brands within modern energy. We believe this is a clear sign that consumers are making modern energy a staple of their lifestyle and recognizing the value of functional beverages.”

“Over the past quarter, Alani Nu has delivered triple-digit growth and captured significant share gains in MULO, while our total portfolio also expanded its position,” Bohannon continued. “Multipacks have been a clear driver of this momentum, as more consumers stock up on functional energy as part of their daily routines, often replacing other caffeinated beverages. We’re also seeing strong traction in grocery, underscoring both the scale we’ve achieved and the runway that remains. We’ve also scaled CELSIUS HYDRATION powder sticks and CELSIUS On-The-Go energy powder sticks, which are now a $100 million business, further extending our reach into functional wellness and addressing the growing consumer demand for versatile, better-for-you formats. Strategic partnerships have also been critical to our growth this year. Our deepened relationship with PepsiCo has accelerated distribution for Celsius and we expect that Alani Nu’s December transition into the PepsiCo system will unlock even greater opportunities for our retail partners through increased displays and broader reach. As PepsiCo’s designated energy captain, we can better work with retailers to optimize shelf sets, curating the right mix of products to meet consumer needs in each market.”

“It’s been a big year for GURU,” said Carl Goyette, President and CEO of GURU Beverage. “It’s a record year for us in terms of innovations. We’ve been really doubling down on zero sugar energy drinks both in Canada and in the US. This has been long in the making because it’s hard to make organic energy drinks with zero sugar because when you’re organic and better for you, you can’t use sucralose and aspartame. We’ve been trying to make a great tasting zero sugar product for many years and in the past we were never able to achieve it. But with new natural ingredients that came onboard, we’ve been able to achieve it. And so far, they’re doing really well. I’d say this has been the year of zero sugar without sucralose and aspartame for us. We were always prioritizing taste. We knew that if consumers tried it, it needed to taste good, and we were not quite there in the past. Obviously there are a lot of zero sugar options out there on the market but 99 percent of zero sugar options are full of sucralose and aspartame and that’s easy. You can [replace] sugar with sucralose and aspartame, and then you have a zero sugar product, but there’s a lot of controversy around these ingredients, and that’s not the way we do products. We do products with natural plant-based ingredients and we never use artificial ingredients.”

“Convenience is central to the energy drink category and is a major part of why the category continues to outpace broader beverage growth,” Bohannon said. “Today’s consumers want products that are easy to access and fit seamlessly into their routines, whether that means grabbing a multipack during a weekly grocery trip or reaching for a single cold can when they’re on the move. CELSIUS’ refreshing flavors pair well alongside food, giving consumers a functional energy option without the sugar found in traditional sodas. Alani Nu also delivers on this need for convenience, offering a functional, zero-sugar pick-me-up that makes it an ideal choice for a quick, grab-and-go energy boost.”

“For most consumers, energy drinks are very much an impulse buy because of the functionality. People want an energy drink at certain occasions whether that’s before and after sports or whether it’s during long journeys or long drives or it’s an afternoon pick me up when they feel tired,” Goyette said. “This notion of being available close to when you need it, always within arm’s reach cold is really critical. We’re also seeing an increase in consumption of energy drinks with meals, whether it’s lunch—even during the breakfast occasion is increasing. It speaks to how the industry has grown significantly and there are some habitual consumers who actually plan; they’ll buy in bulk, they’ll buy in multipack, they’ll always have energy drinks at home. But there’s still a huge portion that is being consumed on impulse. For retailers, for example, making sure it’s available in the open air cooler, it’s available close to the cash register. That’s why the convenience channel plays such a big part in the industry. The convenience channel is over 60 percent of this industry because it’s easy: I need an energy drink, I go to the convenience store, I grab it and I leave.”