Special Report: Frozen Fruit

Frozen fruit has grown to become much more than the average addition to a smoothie or yogurt parfait. Whether it’s trends on social media such as shaved frozen fruit on a warm summer day or an addition to a cocktail, high-quality frozen fruit has a number of uses and benefits. Many of these benefits surround easy ways to add nutrients to meals, but alongside this, affordability has reigned as one of the top reasons consumers gravitate toward the category. As fruit can easily be forgotten and spoiled in the fridge, frozen fruit gives consumers the opportunity to find versatile ways to fit the nutrients into their everyday lives.

“Demand for healthier, convenient food options continues to rise and frozen fruit is well-positioned to meet that need,” Blake Smittcamp, Executive Vice President of Wawona Frozen Foods. “However, we remain mindful of economic pressures, evolving consumer behaviors and supply chain volatility. Our strategy is centered on innovation through product diversification, automation in processing and deepening our sustainability initiatives to align with a values-driven market. We are also monitoring external factors such as tariffs that could impact our supply chain and overall operational agility.”

Although prices continue to rise, Wawona never sacrifices on quality. “One of the biggest challenges we face is managing rising production and logistics costs while maintaining our commitment to high quality and competitive pricing. Tariff uncertainty adds another layer of complexity, particularly when it comes to sourcing packaging materials and importing select frozen fruits used in our custom blends. These additional costs can ripple through our operations and influence our pricing strategies. That said, these challenges also sharpen our focus on key opportunities, most notably, expanding our value-added offerings like pre-portioned smoothie packs and clean-label fruit blends that resonate with today’s health-conscious consumers. On the domestic front, we see significant growth potential in both foodservice and retail, especially with partners who value reliability, traceability and premium frozen fruit,” said Smittcamp.

Suppliers are also taking advantage of tradeshows to introduce products and gauge interest from event attendees. One notable example is Campoverde, which sampled a new fruit on a stick offering, available in mango, watermelon and assorted flavors at the Summer Fancy Food Show in late June.

Meanwhile, Seal the Seasons entered this year with a hopeful mindset of what is on the horizon. “At Seal the Seasons the outlook for 2025 [has been] incredibly strong,” said Patrick Mateer, CEO of Seal the Seasons. “We expect geopolitical and economic uncertainty to ease in the coming months and inflation expectations to remain low to medium. We see strong consumer demand for local frozen fruit as our brand’s unit growth continues to outpace the category. We launched a successful new innovation late in 2024 so our focus is on increasing distribution on this recent success rather than developing new items. Seal the Seasons is expanding our capacity for launching innovation under owned brands by strengthening our strategic partnerships. We will share these strategic partnership announcements with owned brand managers at major chains in Q2 of this year.”

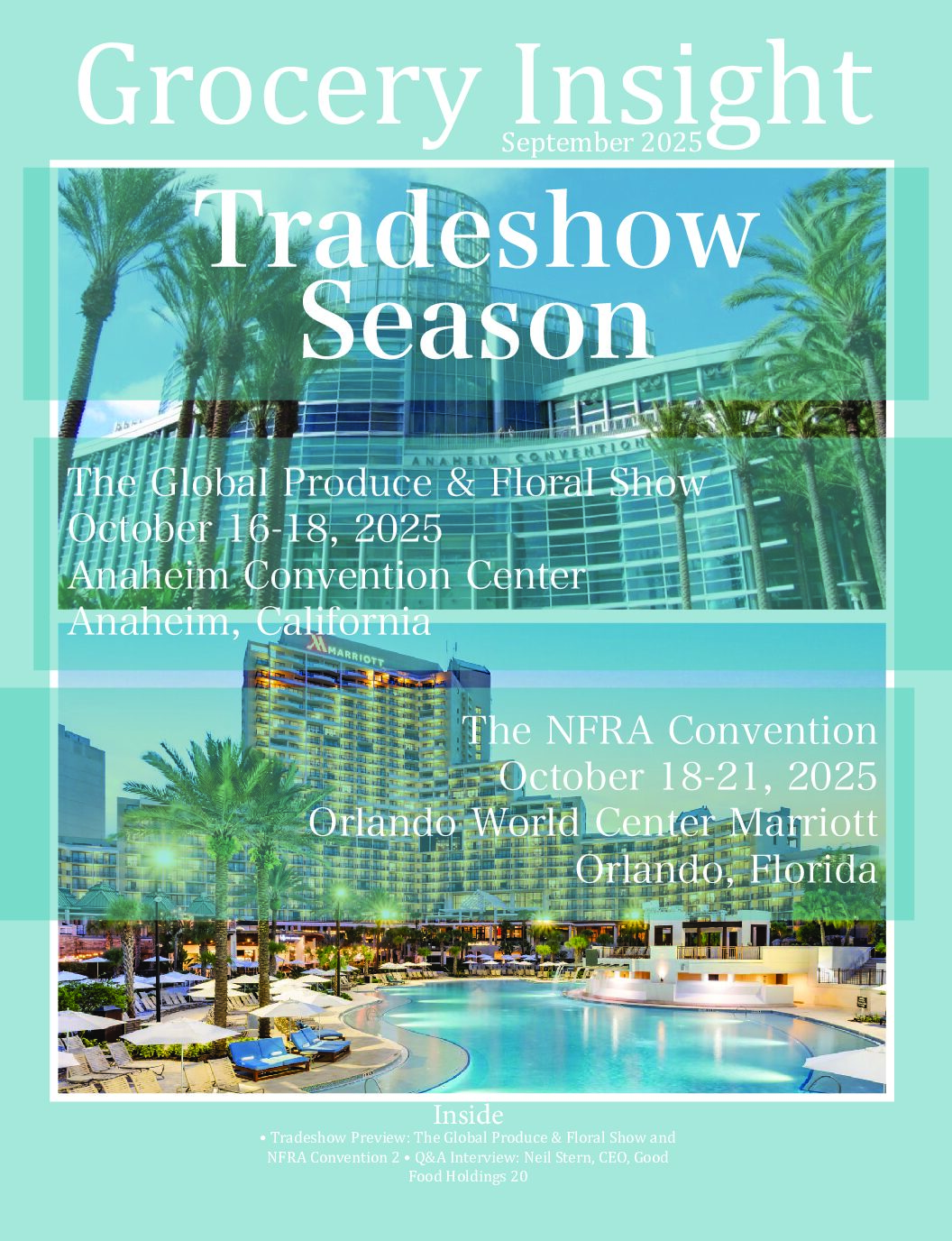

Retailers planning to attend the NFRA Convention shared their goals and expectations for this highly anticipated show. “NFRA is invaluable not only for the connections it fosters, but also as an essential hub for networking among individuals across the dairy and frozen industry,” said Kimberly Dale, Director of Dairy & Frozen at Giant Eagle.

“The NFRA Convention continues to provide valuable networking opportunities and a platform to meet with key industry leaders in a highly efficient setting. The balance of business meetings, educational sessions and industry insights makes it a must-attend for our team each year,” said Stephanie Grant, Merchandising Category Manager at Houchens Food Group. “Our main goals are to strengthen existing relationships, explore new business opportunities and gain insights into upcoming category and shopper trends. We are also focused on aligning with partners to drive growth in frozen and refrigerated products across grocery and convenience.”

“Expected conversations will center on defining what innovation looks like, exploring how to reach untapped guests within the dairy and frozen assortments and identifying ways to support and grow together as a collective team, cultivating the retailer and supplier relationship,” said Dale. “As a retailer, we have seen unprecedented demand for meetings. These meetings will focus on key growth initiatives, innovation and forward-thinking tactics and brainstorming.”

“We are focused on maximizing meeting efficiency by prioritizing high-impact conversations, preparing targeted agendas and ensuring alignment with partner objectives before the convention,” said Grant with Houchens.